The Financing Process

Demystifying Home Loans

The home loan process can feel overwhelming. By collaborating with a trusted lender and remaining informed through every step of the process, from pre-approval to closing, you can have a significantly more comfortable experience. You’ll want to consult with a mortgage specialist (or two) to find a professional who you are confident will provide you with the best care.

To get an idea of what to expect, review the following home loan process steps.

Attorney's Title Group

Robbie Wilson

Co-Managing Partner

Supervising Attorney

About Me

Robbie Wilson received his education from Tulane University in New Orleans, LA (B.A., 2009) and the University of Arkansas School of Law (J.D., 2013). He was admitted into the Arkansas Bar in 2013, the Mississippi Bar in 2018, the Tennessee Bar in 2021, and is licensed to practice before the 8th Circuit Court of the United States.

Robbie is the Central Arkansas Representative of the YLS to the Arkansas Bar Association, is a member of the Pulaski County Bar Association and the Judge Henry Woods Inns of Court, and is a board member of the Pulaski County Bar Foundation. He was an honoree of the 2015 Class of Little Rock’s Finest awarded by the Cystic Fibrosis Foundation. In addition to title and closing, his professional experience includes mortgage banking and real estate litigation.

Contact Me

The Bank of Little Rock

Patrick Dennis

Loan Officer

NMLS# 458047

My Real Job.

The thing I like most about working at Bank of Little Rock Mortgage is the power to assist customers in the largest purchase of their lives by helping them make an informed decision on a loan program that will fit their current financial scenario with their long term goals in life. “Real People. Real Results.” is a very true statement. It’s how we do business.

My Real Life.

Enjoying time with my wife Shannon and watching our two kids grow up is special to me. Whether it’s watching our son play baseball or one of my daughter’s dance recitals, anytime around my family is time well spent.

My Real Story.

Honestly, it’s hard to pick just one. With my job, I get to help so many people with a really significant part of their life. But I get a lot of satisfaction out of assisting older people refinance their homes to a more manageable payment in retirement. Knowing that I’m making their retirement more smooth and less stressful is very gratifying.

Contact MeStep One:

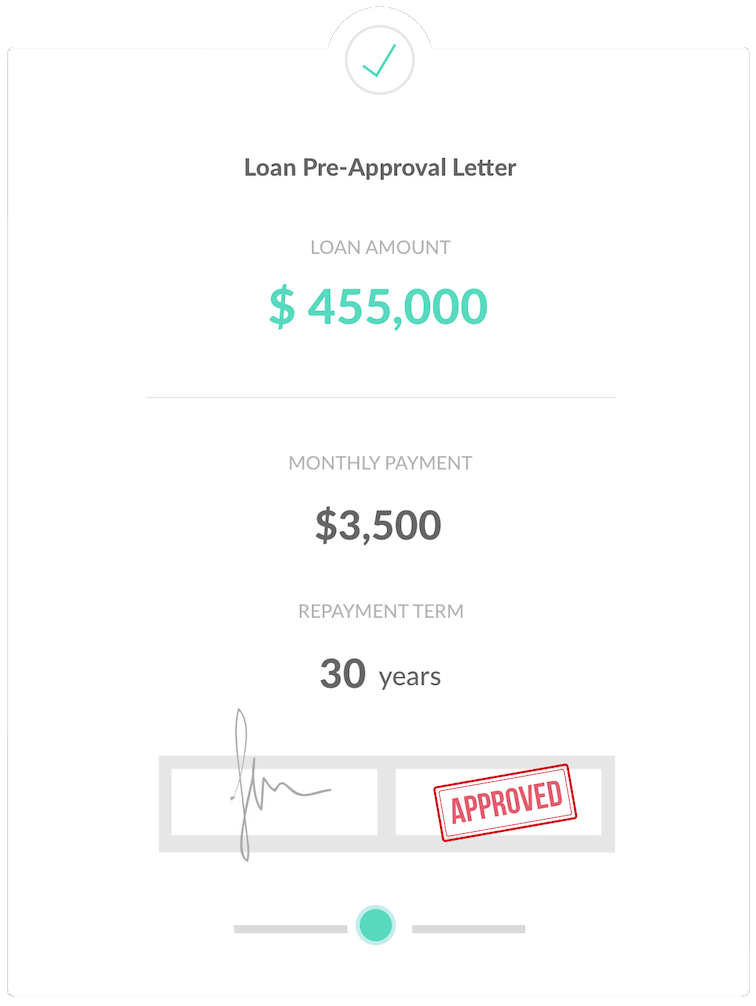

Get Pre-Approval

Before you start looking for a home to buy, it’s wise and proactive to meet with a lender to get pre-approved for a loan amount. Offers accompanied by a pre-approval letter are stronger and will stand out, especially when the seller is receiving multiple offers.

To gain pre-approval, your preferred lender will gather information about income, assets, and debts to help determine how much you can borrow. This includes gathering a credit report, W-2 forms, pay stubs, federal tax returns, and recent bank statements.

There are a variety of home loan programs offering different advantages depending on your unique needs and preferences. Your preferred lender can go over the specifics of each to ensure you find a loan option that best aligns with your needs.

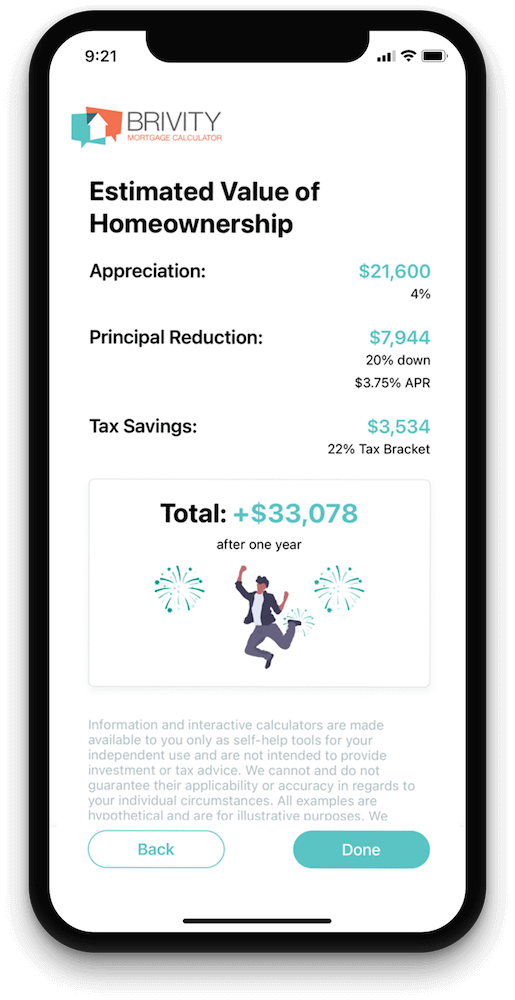

Estimate Your Monthly Payment

Estimate your mortgage payment, including the principal and interest, taxes, insurance, HOA, and Private Mortgage Insurance.

Price

Annual Tax

Loan Term (Years)

Down Payment %

Interest Rate %

Monthly HOA

Monthly Insurance

$3,198.20

Estimated Monthly Payment

Principal

$2,398.20

(75.0%)Taxes

$500.00

(15.6%)Private Mortgage Insurance (PMI)

$0.00

(0.0%)HOA

$100.00

(3.1%)Insurance

$200.00

(6.3%)

Step Two:

Find the best loan

Collaborating with a top-notch local loan officer will ensure you have access to competitive rates and programs that best fit your individual needs. Take the first step by completing this form to get connected today!

Step Three:

Application and processing

When you find the perfect property and your offer is accepted, your lender will help you complete a full mortgage loan application, discuss down payment options, and explain any related fees.

Then, your application is submitted for processing where the documents are reviewed. Your lender will also order a home appraisal and a property title search.

The next part of the application process involves sending everything to an underwriter who will review and approve the entire loan package to make sure it meets all compliance regulations.

It is not unusual to receive requests for additional documentation or clarification during this phase of the application process.

Step Four:

Signing and finalizing the deal

Once your loan is approved, you’ll need to set up homeowners insurance.

Your documents will be sent to the title company and the closing will be scheduled for you to sign the necessary paperwork and pay any additional costs to complete the purchase of your new home.

After the loan goes through the required recording process, the purchase is complete, and you officially own your new home!